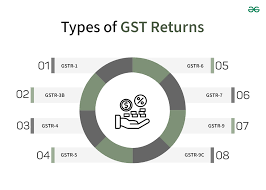

Types of gst return

In India, there are several types of GST returns that businesses must file based on the nature of their operations. Here's a summary of the key types of GST returns under the Goods and Services Tax regime:

1. GSTR-1

Filed by: Regular taxpayers

Frequency: Monthly/Quarterly (depending on turnover)

Purpose: Details of outward supplies (sales) of goods or services

2. GSTR-2A / GSTR-2B

Filed by: Auto-generated for recipients

Purpose:

GSTR-2A: Dynamic statement of inward supplies (for viewing only)

GSTR-2B: Static ITC (Input Tax Credit) statement (used for ITC claims)

3. GSTR-3B

Filed by: Regular taxpayers

Frequency: Monthly

Purpose: Summary return of outward supplies, input tax credit, and tax liability

4. GSTR-4

Filed by: Composition scheme taxpayers

Frequency: Annually

Purpose: Summary of outward and inward supplies and tax paid

5. CMP-08

Filed by: Composition scheme taxpayers

Frequency: Quarterly

Purpose: Statement for payment of self-assessed tax

6. GSTR-5

Filed by: Non-resident foreign taxpayers

Frequency: Monthly

Purpose: Summary of outward and inward supplies

7. GSTR-6

Filed by: Input Service Distributors (ISD)

Frequency: Monthly

Purpose: Distribution of input tax credit among branches

8. GSTR-7

Filed by: Persons required to deduct TDS under GST

Frequency: Monthly

Purpose: Details of TDS deducted

9. GSTR-8

Filed by: E-commerce operators

Frequency: Monthly

Purpose: Details of TCS (Tax Collected at Source)

10. GSTR-9

Filed by: Regular taxpayers

Frequency: Annually

Purpose: Annual return summarizing all monthly/quarterly returns

11. GSTR-9A (now discontinued)

Was for: Composition taxpayers

Status: Not required after FY 2018–19

12. GSTR-9C

Filed by: Taxpayers with turnover above ₹5 crore

Frequency: Annually

Purpose: Reconciliation statement between GSTR-9 and audited financials

13. GSTR-10

Filed by: Taxpayers whose GST registration is cancelled/surrendered

Purpose: Final return

14. GSTR-11

Filed by: UIN (Unique Identification Number) holders (e.g., embassies)

Purpose: Claim refund of taxes on inward supplies