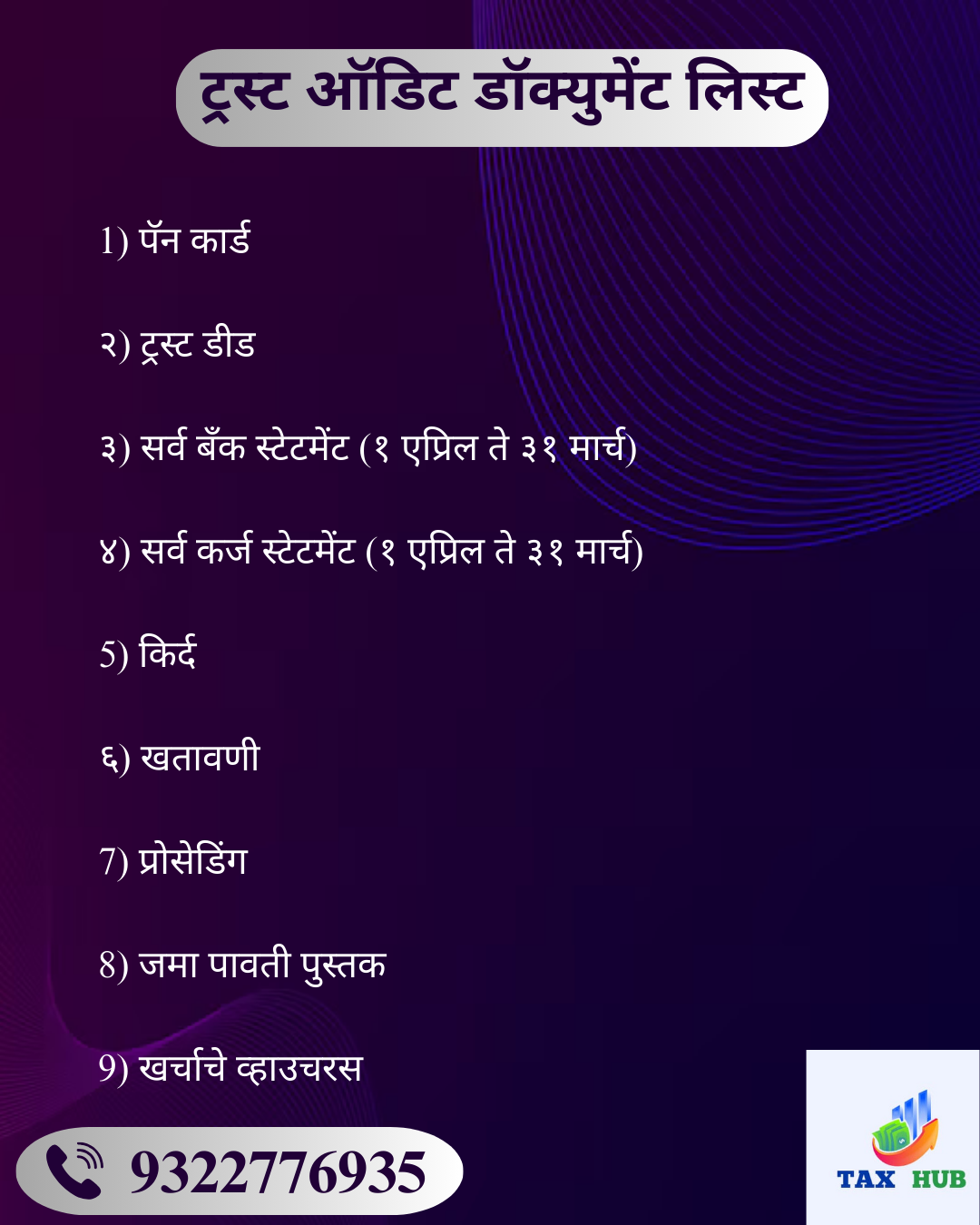

In India, a trust audit is a mandatory financial review for charitable or religious trusts registered under Section 12A/12AB of the Income Tax Act, 1961, if their total income (before exemptions under Sections 11 and 12) exceeds ₹2.5 lakh in a financial year. The audit, conducted by a Chartered Accountant, ensures compliance with legal and tax regulations and must be reported in Form 10B, filed by September 30 (one month before the ITR-7 deadline of October 31). The audit verifies income, expenditure, application of funds (minimum 85% for charitable purposes), and adherence to relevant provisions. Required documents include the trust deed, PAN, books of accounts, bank statements, donation records, and asset details. Failure to conduct the audit may lead to loss of tax exemptions and taxation at the maximum marginal rate.