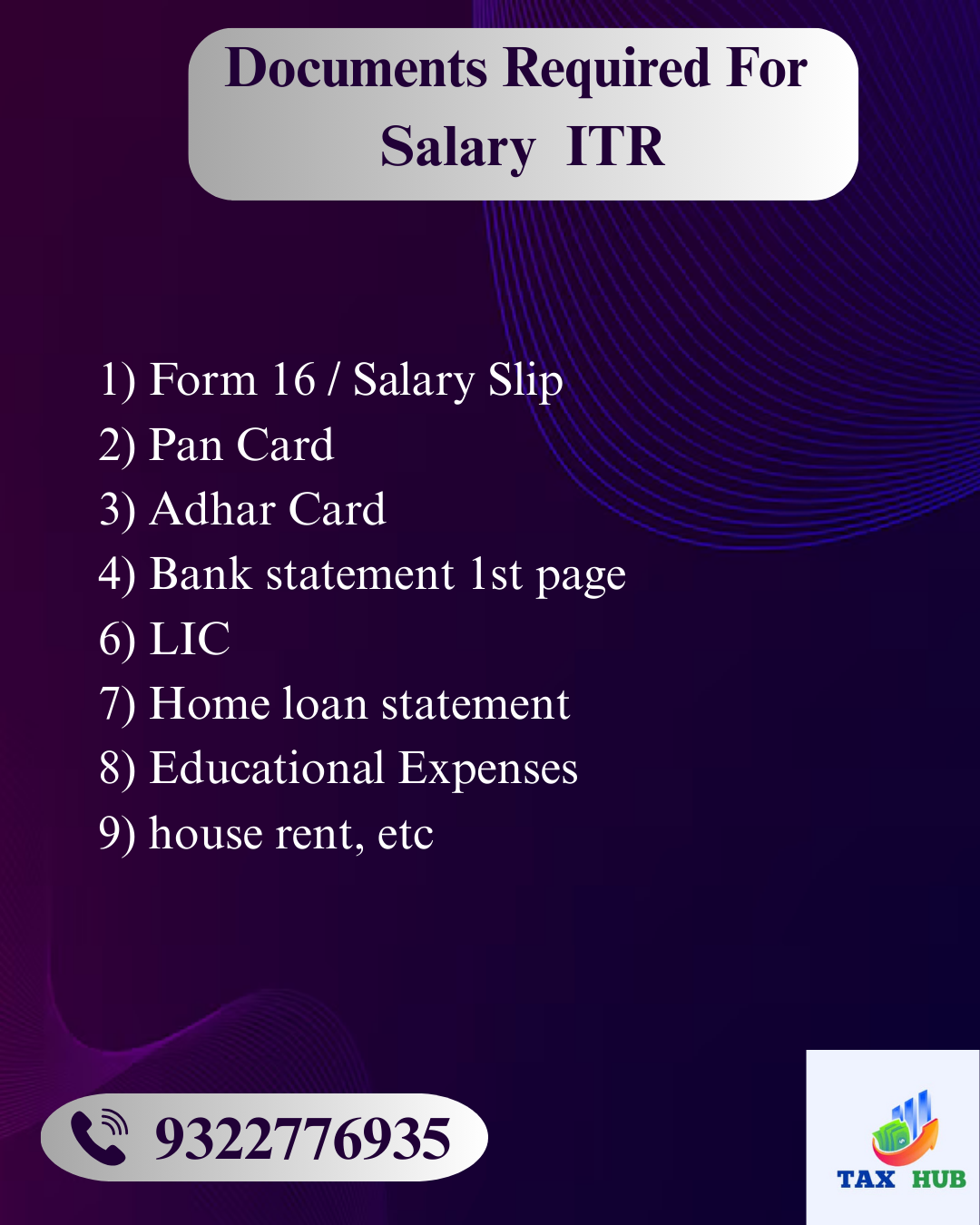

Salary ITR is the Income Tax Return filed by individuals earning mainly from salary. Common forms are ITR-1 (income up to ₹50 lakh), ITR-2 (above ₹50 lakh or capital gains), ITR-3 (salary + business income), and ITR-4 (presumptive income). Salary includes basic pay, HRA, LTA, bonuses, and retirement benefits. Taxable income is calculated after deductions under sections like 80C, 80D, and 24(b). Required documents include Form 16, PAN, Aadhaar, salary slips, and Form 26AS. The due date is 31st July; late filing attracts penalties. Always match Form 16 with Form 26AS and choose the right tax regime.