Project Report

A project report is a comprehensive document that outlines all key aspects of a business proposal. It helps banks or financial institutions evaluate the feasibility and repayment capacity before sanctioning a loan.

1. Cover Page

Name of the business/entrepreneur

Title: Project Report for Bank Loan

Business address and contact details

Date

2. Executive Summary

Brief overview of the project

Loan amount required

Purpose of the loan

Expected outcomes (growth, revenue, employment)

3. Promoter/Business Profile

Name and background of the promoter(s)

Education & experience in the relevant field

KYC documents (PAN, Aadhaar)

Past business ventures (if any)

4. Business Details

Name of the business

Nature:Proprietorship / Partnership / Company

Type:Manufacturing / Trading / Service

Business location (owned/rented)

Registration details (GST, MSME, etc.)

5. Project Objectives

Purpose and goals of the business/project

Mission and vision statements

6. Product or Services Offered

Detailed description of products/services

Unique Selling Proposition (USP)

Market demand and target audience

7. Market Analysis

Industry overview

Target market & customer base

Competition analysis

SWOT: Strengths, Weaknesses, Opportunities, Threats

8. Infrastructure & Resources

Land, building, machinery, and equipment details

Raw material requirements

Human resources & skill set needed

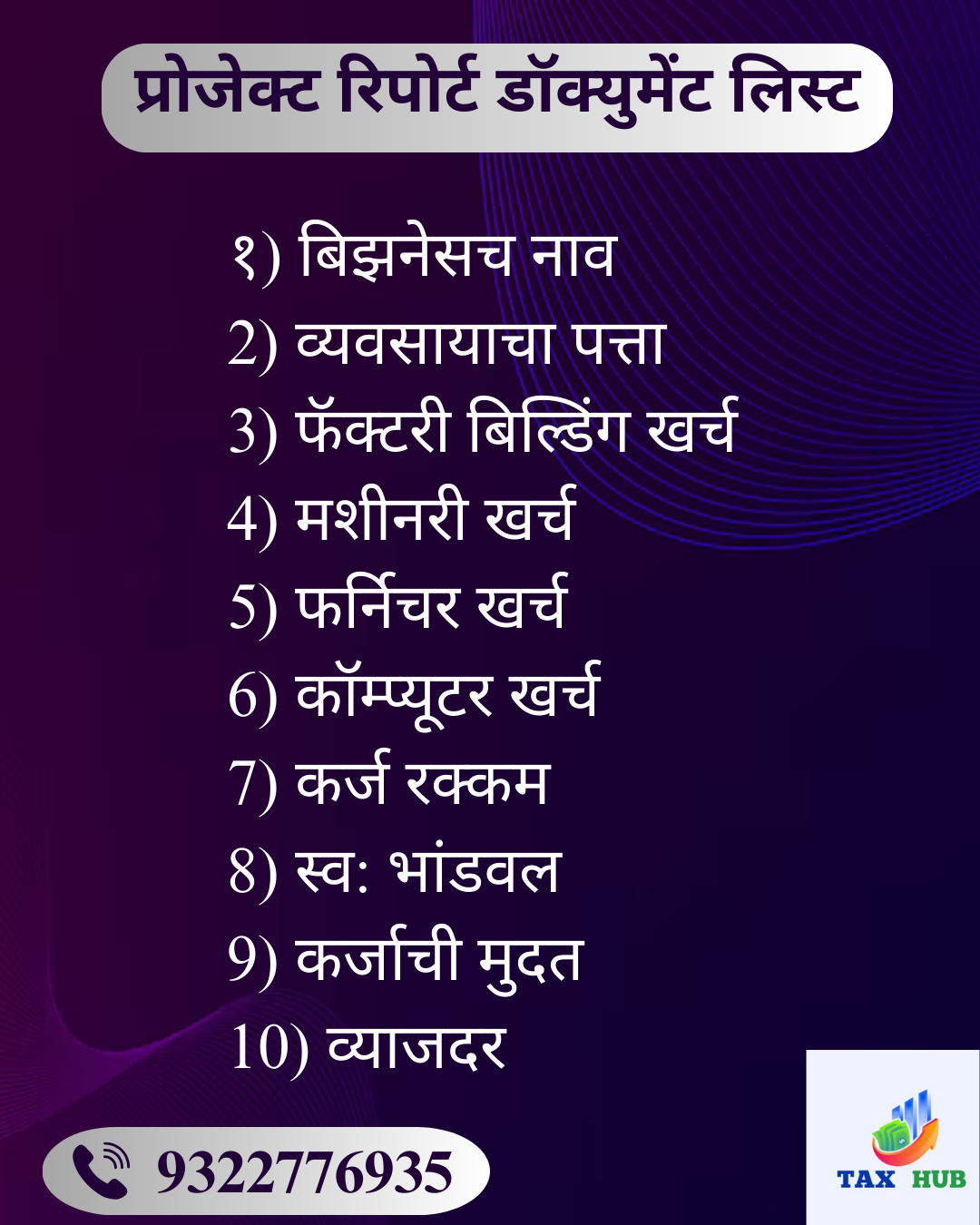

9. Financial Details

a) Cost of Project

Land & Building

Plant & Machinery

Working Capital

Other assets

b) Means of Finance

Promoter’s contribution

Bank Loan required

Subsidies (if any)

10. Financial Projections (for 3 to 5 years)

Projected Profit & Loss Account

Projected Balance Sheet

Cash Flow Statement

Break-even Analysis

Repayment schedule

11. Loan Details

Loan amount requested

Type of loan: Term loan / Working Capital

Repayment period

Collateral security offered

12. Attachments / Annexures

KYC documents of promoters

Income Tax Returns

Bank statements

Business registrations (GST, MSME, Shop License)

Quotations for machinery or raw materials

Rent Agreement/Property Proof

Previous loan details (if any)

Key Tips

Keep the report concise but informative

Use charts/graphs where applicable

Ensure all numbers are realistic and backed with data

Highlight how the loan will be utilized and repaid

Types Of Project Report

| Type of Project Report | |

|---|---|

| Startup Project Report | Prepared for new business ventures to secure initial funding from banks. |

| Expansion Project Report | Used when an existing business seeks funds for growth or expansion of operations. |

| Modernization Project Report | Focused on upgrading existing facilities, technologies, or equipment with loan support. |

| Diversification Project Report | Prepared when a business plans to enter into a new product line or market segment. |

| Working Capital Project Report | Helps secure short-term loans to finance daily operations and cash flow requirements. |

| Term Loan Project Report | Used to obtain long-term loans for capital investments like land, building, or machinery. |

| Service-Based Project Report | Tailored for businesses offering services instead of physical products. |

| MSME Loan Project Report | Specifically for Micro, Small, and Medium Enterprises applying under MSME schemes. |

| Mudra Loan Project Report | For small businesses applying under Pradhan Mantri MUDRA Yojana (PMMY). |

| PMEGP/CMEGP Project Report | For applicants under Prime Minister’s Employment Generation Programme (PMEGP) or Chief Minister’s Employment Generation Programme (CMEGP). |

Importance and Benefits of a Project Report

Importance of a Project Report

Blueprint for the Business

It acts as a roadmap, outlining objectives, strategies, financials, and timelines to ensure clarity and direction.

Decision-Making Tool

Helps entrepreneurs and stakeholders make informed business decisions by analyzing feasibility, risk factors, and market potential.

Project Evaluation

Helps evaluate whether the project is worth pursuing and identifies areas that need improvement or further research.

Communication Document

Serves as a formal document for communicating business goals, plans, and expectations with partners, investors, and other stakeholders.

Benefits of a Project Report

Clarity and Focus

Provides a structured plan, ensuring that the team remains focused on key objectives and milestones.

Performance Monitoring

Facilitates progress tracking against timelines, budgets, and goals, allowing for timely interventions if needed.

Resource Planning

Helps in allocating resources efficiently—such as manpower, finance, and raw materials—by estimating needs in advance.

Enhances Credibility

A well-prepared report boosts the credibility of the business idea in the eyes of banks, investors, and government agencies.