What is GST Registration?

GST (Goods and Services Tax) registration is a mandatory process for businesses whose turnover exceeds the threshold limit set by the government. Once registered, a unique GSTIN (Goods and Services Tax Identification Number) is issued.

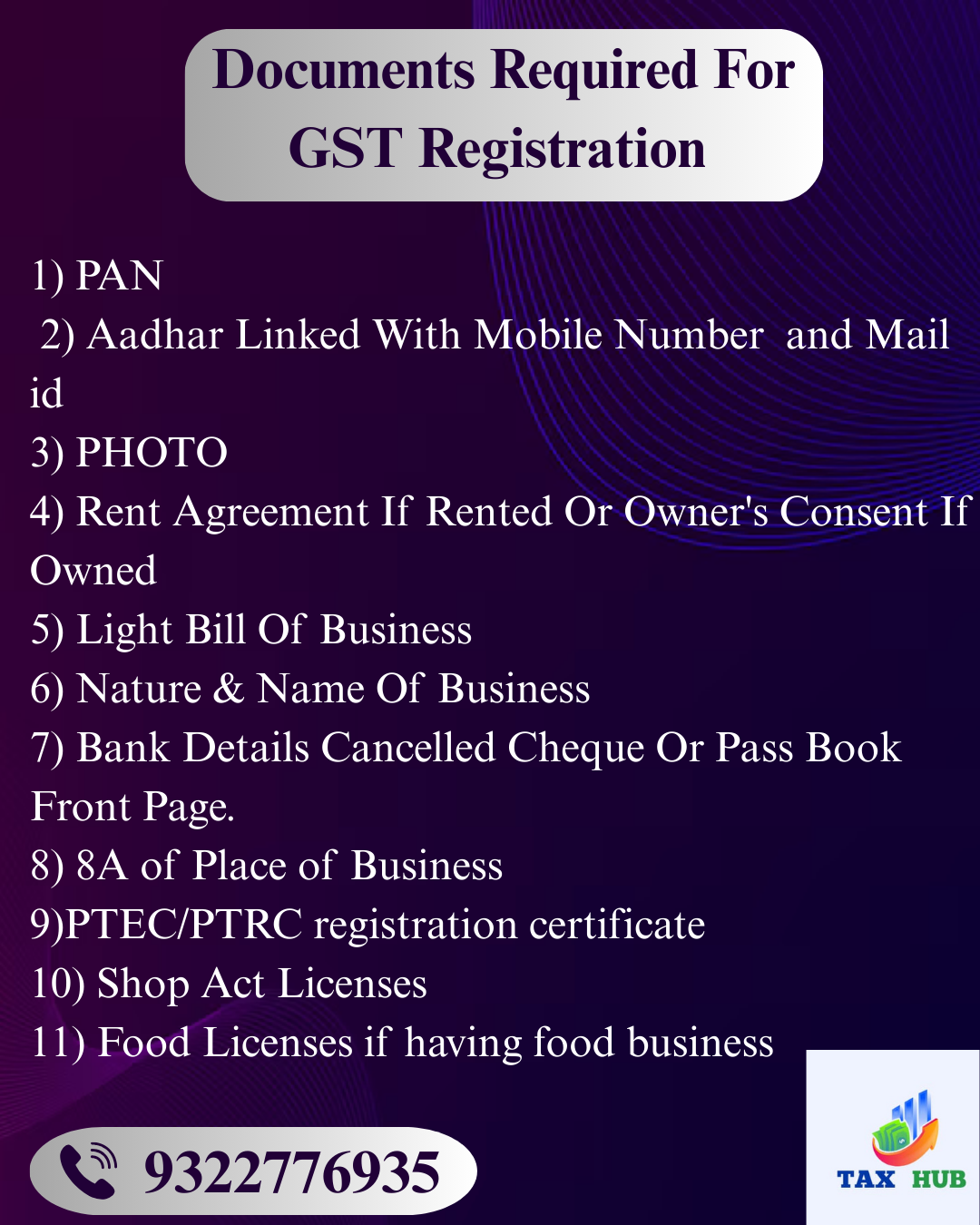

Document Requirements for GST Registration

1. PAN card of the business or applicant

2. Aadhaar card

3. Proof of business registration (e.g., partnership deed, incorporation certificate)

4. Address proof of place of business (rent agreement, electricity bill, etc.)

5. Bank account statement or cancelled cheque

6. Digital Signature (for companies and LLPs)

7. Photographs of the proprietor/partners/directors

GST Registration Process

Step 1: Visit the official GST portal (www.gst.gov.in)

Step 2: Click on ‘New Registration’

Step 3: Fill in the required details (PAN, email, mobile number, state)

Step 4: Enter OTP received and proceed

Step 5: Complete the application form (Part B) with documents

Step 6: Submit the application with DSC or EVC

Step 7: ARN (Application Reference Number) is generated

Step 8: Receive your GSTIN after verification

Expert Assistance

✅ Hassle-free filing and documentation

✅ Avoid errors and rejection

✅ Guidance on applicable GST laws

✅ Timely updates and follow-up

What is the GST Framework as per the new Law?

GST Framework as per the New Law:1. Dual GST Model:

India follows a dual GST model where both the Centre and States levy GST simultaneously on a common tax base.

2. Components of GST:

CGST: Collected by the Central Government on intra-state supply of goods and services.

SGST: Collected by the State Government on intra-state supply of goods and services.

IGST: Collected by the Central Government on inter-state supply of goods and services.

3. Destination-Based Taxation:

GST is a destination-based tax, which means the tax revenue goes to the state where the goods or services are consumed.

4. Comprehensive Coverage:

GST subsumes multiple indirect taxes such as VAT, excise duty, service tax, etc., bringing uniformity in tax structure.

5. Input Tax Credit (ITC):

Businesses can claim credit for the tax paid on purchase of goods/services, which helps eliminate cascading effect of taxes.

6. Threshold Exemption:

Businesses with an annual turnover below the prescribed limit are exempt from GST registration.

7. Composition Scheme:

Small taxpayers can opt for a composition scheme to pay tax at a fixed rate on turnover, reducing compliance burden.

8. GST Council:

A constitutional body comprising representatives from the Centre and States to make decisions on GST rates, rules, and exemptions.

9. Compliance and Filing:

Regular filing of GST returns is mandatory, including monthly, quarterly, and annual returns through the GST portal.

10. E-Invoicing and E-Way Bill:

Mandatory e-invoicing for certain businesses and generation of e-way bill for movement of goods to enhance transparency and tracking.

Advantages of GST Registration

1. Legal Recognition:

GST registration provides legal recognition as a supplier of goods or services.

2. Input Tax Credit (ITC):

Businesses can claim ITC on GST paid on purchases, reducing overall tax liability.

3. Interstate Sales:

Allows businesses to make interstate sales without restrictions.

4. Competitive Advantage:

GST-registered businesses are preferred by buyers and large companies.

5. Compliance Benefits:

Simplified tax compliance through a unified GST portal for all returns and payments.

6. Easy Loans and Funding:

GST registration helps build business credibility and financial records, aiding in bank loans or funding.

7. E-commerce Participation:

Enables selling on e-commerce platforms like Amazon or Flipkart, which require GSTIN.

8. Avoid Penalties:

Helps avoid penalties and legal issues due to non-registration when turnover exceeds the threshold limit.

Disadvantages of GST Registration

1. Increased Compliance:

Businesses must file monthly, quarterly, and annual GST returns, increasing administrative work.

2. Higher Operational Costs:

Hiring professionals or using accounting software to manage GST increases operational expenses.

3. Penalty for Non-Compliance:

Delayed or incorrect filing can lead to heavy penalties and interest charges.

4. Complex Procedures:

Understanding and managing various GST provisions, rates, and classifications can be complicated.

5. Cash Flow Issues:

Input tax credit is available only after filing returns, which may delay refunds and affect working capital.

6. Not Beneficial for Small Businesses:

For businesses with low turnover, the cost and compliance burden may outweigh the benefits.

💼 Turnover Criteria for GST Registration

Under the Goods and Services Tax (GST) regime in India, businesses are required to register under GST if their aggregate turnover exceeds a specified threshold limit. These limits vary based on the type of supply (goods or services) and the state in which the business operates.

📊 Threshold Limits for GST Registration

| Type of Supply | Normal Category States | Special Category States |

|---|---|---|

| Goods (Intra-State Supply) | ₹40 lakhs | ₹20 lakhs |

| Services (Intra-State Supply) | ₹20 lakhs | ₹10 lakhs |

| Goods + Services (Mixed Supply) | Higher of ₹40 lakhs or ₹20 lakhs (as applicable) | ₹10 lakhs or ₹20 lakhs (as applicable) |

Special Category States include: Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Uttarakhand, Himachal Pradesh.

Aggregate Turnover – Meaning

Includes:

✅ Taxable supplies

✅ Exempt supplies

✅ Exports

✅ Inter-state supplies

Excludes:

❌ Central GST (CGST), State GST (SGST), Union Territory GST (UTGST), and Integrated GST (IGST)

Note: Aggregate turnover is calculated on an all-India basis for businesses with the same PAN.

🚨 Mandatory GST Registration (Irrespective of Turnover)

Businesses must register under GST even if turnover is below the threshold, in the following cases:

- Inter-state supply of goods

- E-commerce operators or sellers on e-commerce platforms (e.g., Amazon, Flipkart)

- Casual taxable persons

- Input Service Distributors (ISD)

- Non-resident taxable persons

- Reverse Charge Mechanism applicability

- Agents of a supplier

📝 Example Scenarios

Delhi Trader selling goods locally with ₹42 lakhs turnover – GST registration required (limit: ₹40 lakhs)

Nagaland Service Provider with ₹11 lakhs turnover – GST registration required (limit: ₹10 lakhs)

Maharashtra Consultant earning ₹19 lakhs – No GST registration needed (limit: ₹20 lakhs)